M&A advisory for middle-market transactions. Our team brings decades of deal-making experience across diverse sectors. We combine traditional M&A expertise with proprietary systems to deliver higher transaction values and faster closings.

M&A Advisory Services

Full-service M&A advisory combining deal-making expertise with proprietary systems to deliver higher transaction values

Sell-Side Mandates

Expert M&A Advisory

Buy-Side Mandates

Deal Sourcing & Integration

Market Studies

Live Market Intelligence

Commercial DD

Enhanced Due Diligence

Sell-Side Mandates

We design and execute sell-side processes that maintain momentum throughout the transaction. Your buyer universe is built from verified transaction data and market intelligence. Every management answer is backed by systematic research, and investors receive materials that facilitate efficient diligence—all delivered on accelerated timelines.

Ready to discuss your M&A transaction with experienced advisors?

Schedule a ConsultationExperience-Driven Advisory

GA Capital is an M&A advisory firm with decades of deal-making experience. Our team has executed $90B+ in transactions across diverse sectors, bringing institutional-quality advisory to middle-market transactions.

We combine traditional M&A expertise with proprietary systems that enhance our capabilities, enabling faster timelines and systematic analysis. Our experienced professionals lead all deal structuring, negotiation, relationship management, and deal execution—the essential elements for closing complex transactions.

Our Approach

Our proprietary systems enhance execution efficiency and support our advisory services, enabling our experienced team to deliver higher transaction values and faster closings.

Execution Efficiency

Our Team

Experienced M&A professionals with decades of combined deal-making expertise across diverse sectors

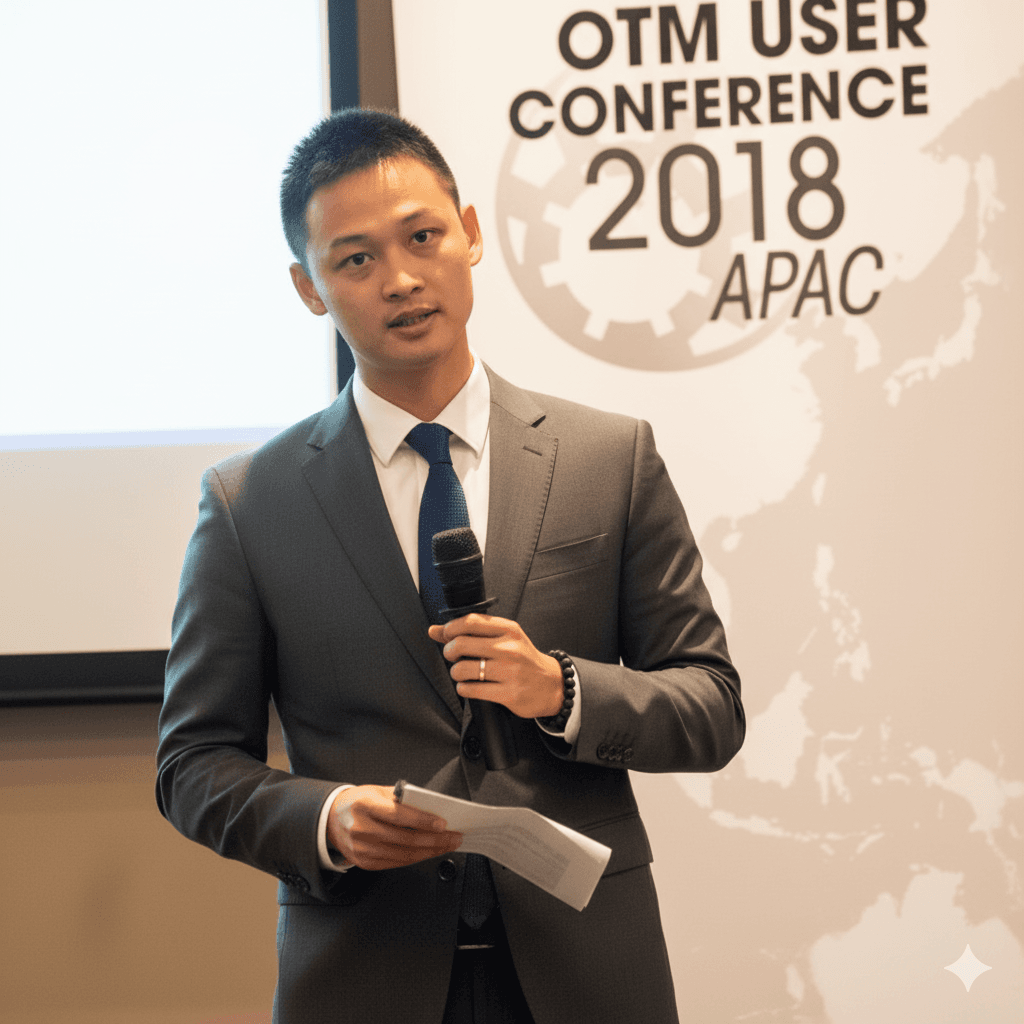

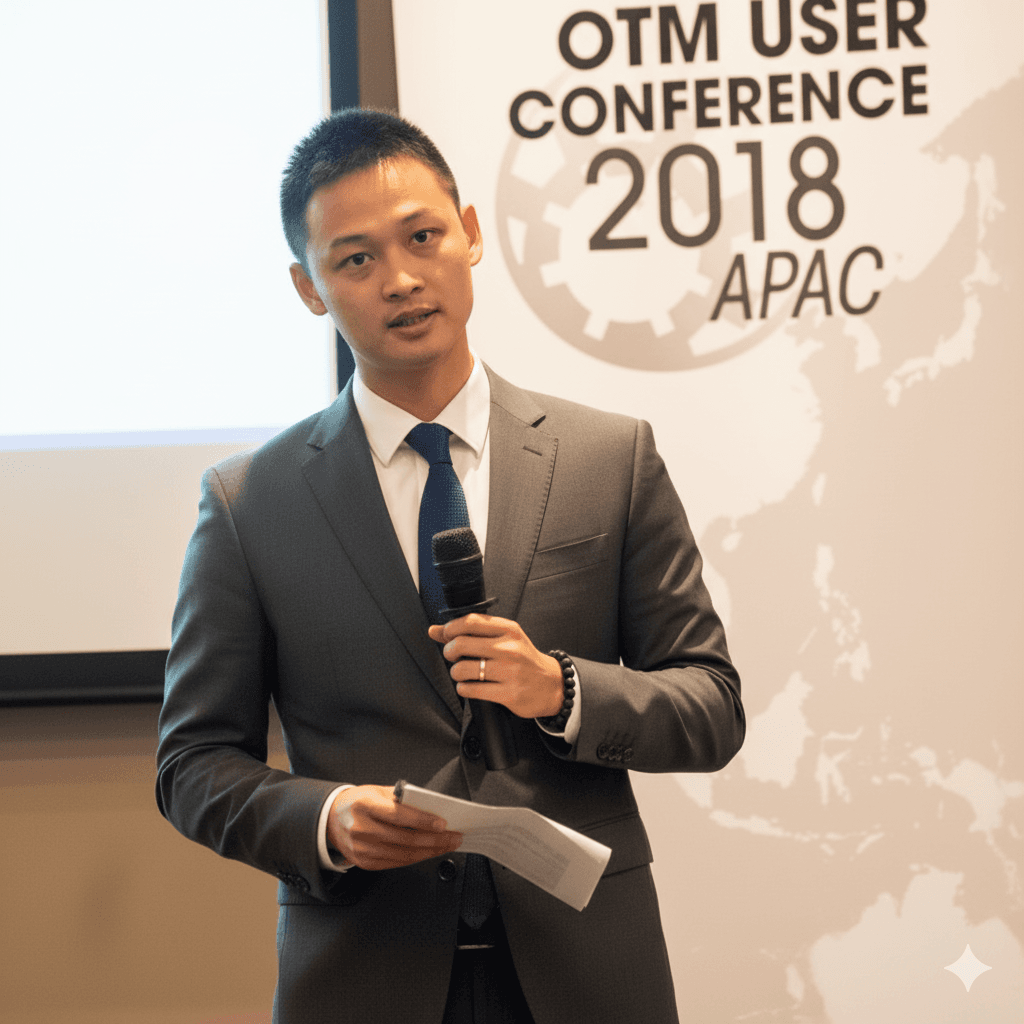

Principal responsible for deal execution. Lawyer with experience in Corporate Development at Bac Ky Logistics and Indotrans Logistics.

Hanh Ngo

Principal

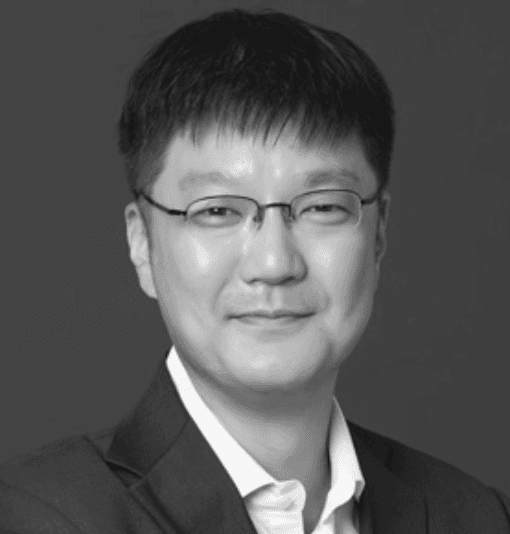

Former CEO of Bac Ky Logistics, which was successfully sold to ITL. Previously ran his own industrial real estate fund in Vietnam.

Trung Le Duc

Partner

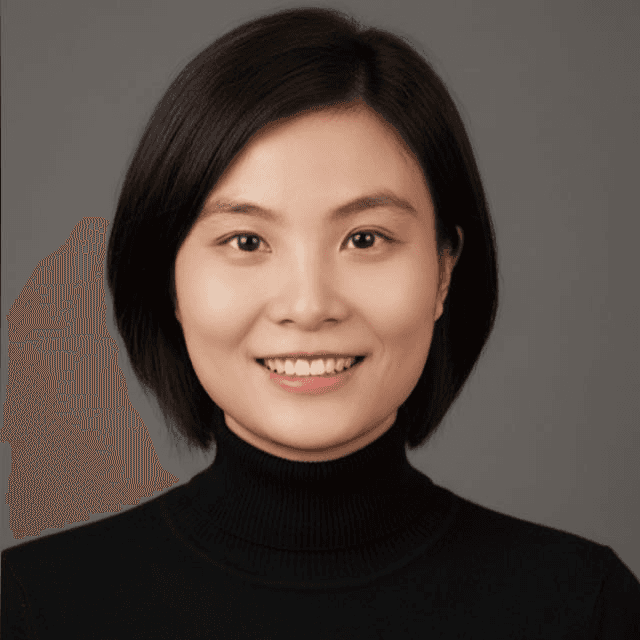

CEO of EMP Belstar and former SuperFreeze executive with deep expertise in private equity and cross-border investments.

Tony Chang

Advisor

Turkish economist and Member of Parliament with extensive government and academic experience. Former advisor to Turkey's Central Bank and Ministry of Finance, Professor of Economics with PhD from Boston College. Deep connections in Turkish business and government circles, currently teaching Development Economics at Harvard Summer School.

Ümit Özlale

Advisor

Principal responsible for deal execution. Lawyer with experience in Corporate Development at Bac Ky Logistics and Indotrans Logistics.

Hanh Ngo

Principal

Former CEO of Bac Ky Logistics, which was successfully sold to ITL. Previously ran his own industrial real estate fund in Vietnam.

Trung Le Duc

Partner

CEO of EMP Belstar and former SuperFreeze executive with deep expertise in private equity and cross-border investments.

Tony Chang

Advisor

Turkish economist and Member of Parliament with extensive government and academic experience. Former advisor to Turkey's Central Bank and Ministry of Finance, Professor of Economics with PhD from Boston College. Deep connections in Turkish business and government circles, currently teaching Development Economics at Harvard Summer School.

Ümit Özlale

Advisor

Principal responsible for deal execution. Lawyer with experience in Corporate Development at Bac Ky Logistics and Indotrans Logistics.

Hanh Ngo

Principal

Former CEO of Bac Ky Logistics, which was successfully sold to ITL. Previously ran his own industrial real estate fund in Vietnam.

Trung Le Duc

Partner

CEO of EMP Belstar and former SuperFreeze executive with deep expertise in private equity and cross-border investments.

Tony Chang

Advisor

Turkish economist and Member of Parliament with extensive government and academic experience. Former advisor to Turkey's Central Bank and Ministry of Finance, Professor of Economics with PhD from Boston College. Deep connections in Turkish business and government circles, currently teaching Development Economics at Harvard Summer School.

Ümit Özlale

Advisor

Where Our Team Has Worked

Frequently Asked Questions

Understanding our approach to M&A advisory and how we deliver higher transaction values

We are a full-service M&A advisory firm with experienced dealmakers who have completed over $90B+ in transactions. Our team combines decades of deal-making expertise with proprietary systems that enhance our capabilities. Our systems handle data-intensive desktop work – market research, competitive analysis, and buyer identification – enabling our expert dealmakers to focus on deal structuring, negotiation, and closing transactions. This approach delivers faster timelines and higher transaction values.

We specialize in mid-market M&A transactions. Our deal range typically spans from $20 million to $250 million in transaction value. This sweet spot allows us to provide institutional-quality advisory services while maintaining the responsiveness and attention that mid-market companies deserve.

Absolutely. Our team and advisory board consist of expert M&A professionals with decades of combined experience. Our proprietary systems enhance our capabilities but do not replace our dealmakers. Our systems handle data-intensive desktop work, while our experienced professionals lead all deal structuring, strategy, relationship management, and negotiation. Human expertise and relationships are irreplaceable in closing complex transactions.

Desktop work refers to the time-consuming, data-intensive tasks that traditionally require extensive analyst hours: analyzing business data, researching competitors, building market benchmarks, identifying potential buyers, and preliminary due diligence. Our proprietary systems enhance these processes, delivering insights more efficiently – enabling our dealmakers to focus on deal structuring, negotiation, and relationship building.

Our proprietary systems enable us to cover more markets and identify more potential buyers for your business than traditional methods. We deliver answers and insights efficiently with systematic analysis. Our systems process market data systematically, ensuring thorough coverage and timely identification of opportunities. This translates to higher transaction values and faster timelines.

Yes, cross-border M&A is one of our key strengths. International deals often face challenges with regulatory complexity, language barriers, and cultural differences. Our proprietary systems help navigate these challenges by processing multi-jurisdictional regulations and identifying compliance requirements, while our experienced team manages relationships and cultural nuances – making cross-border transactions smoother and less risky.

More efficiently than traditional firms. Our proprietary systems enhance the analysis of your business data – financials, operations, market position – enabling us to build a systematic understanding efficiently. We identify key value drivers and benchmark against competitors, allowing our experienced team to move to deal structuring and execution rapidly.

We handle the full spectrum of M&A transactions in the mid-market: mergers, acquisitions, divestitures, carve-outs, and strategic partnerships. While we work across multiple sectors, our expert team has completed most deals in Transportation, Logistics, Real Estate, Infrastructure, Hospitals, Education, and Diversified Industrials—bringing deep sector knowledge to these industries.

Have more questions about our services?

Contact Our TeamGet In Touch

Ready to discuss your next transaction? Our team is here to help you navigate complex deals and achieve your business objectives.

New York Office

370 W 30TH ST

New York, NY 10001

Ho Chi Minh Office

15 Lê Thánh Tôn, Bến Nghé, Quận 1

Hồ Chí Minh 700000, Sonatus Building

Hanoi Office

289A Khuat Duy Tien

Hanoi, Vietnam

Contact

Email: deal@gacapital.ai

Phone: +(360) 516-1496

Business Hours

Monday - Friday: 9:00 AM - 6:00 PM EST

Weekend: By appointment only